It is an accounting term that helps business owners and managers track product profitability. The contribution margin is important to understand because it shows how much of a product’s revenue is available to cover fixed costs and contribute to the firm’s profit. You might wonder why a company would trade variable costs for fixed costs. One reason might be to meet company goals, such as gaining market share. Other reasons include being a leader in the use of innovation and improving efficiencies.

Analysis and Interpretation

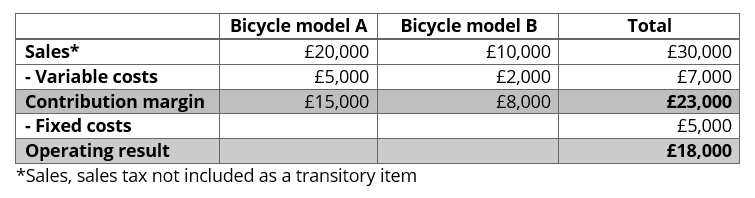

To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. The formula to calculate the contribution margin is equal to revenue minus variable costs. To cover the company’s fixed cost, this portion of the revenue is available. After all fixed costs have been covered, this provides an operating profit.

Contribution Margin Ratio:

While contribution margin is an important business metric, how you calculate variable costs influences the number. And, as a pretty granular number, it gives you insight into a specific product’s profitability, but not the overall company’s profits. For a more holistic view, use it with other profitability ratios such as gross profit, operating profit and net profit. Contribution margin, gross margin, and profit are different profitability measures of revenues over costs. Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs. Contribution margin is the portion of a product’s revenue that exceeds the variable cost of producing that product and generating that revenue.

What is the approximate value of your cash savings and other investments?

- Use contribution margin alongside gross profit margin, your balance sheet, and other financial metrics and analyses.

- Direct variable costs include direct material cost and direct labor cost.

- The variable portion of the firm’s costs is deducted from the revenue.

- CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a product, or accept potential customer orders with non-standard pricing.

You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. By multiplying the total actual or forecast sales volume in units for the baseball product, you can calculate sales revenue, variable costs, and contribution margin in dollars for the product in dollars. Selling price per unit times number of units sold for Product A equals total product revenue. You subtract the $300,000 in fixed costs to get $200,000 in operating profit.

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. Crucial to understanding contribution margin are fixed costs and variable costs. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. A good example of the change in cost of a new technological innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time.

The same will likely happen over time with the cost of creating and using driverless transportation. Contribution margin is not an all-encompassing measure of a company’s profitability. However, contribution margin can be used to examine variable production costs. The contribution margin can also be used to evaluate the profitability of an item and calculate how to improve its profitability, either by reducing variable production costs or increasing the item’s price. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale.

To calculate the unit contribution margin, you subtract the variable costs per unit from the selling price per unit. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\). This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. Gross margin is synonymous with gross profit margin and includes only revenue and direct production costs.

It can also include the firm’s profit if the amount exceeds the total amount of the fixed costs. When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the what is the cycle time formula costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue.